Taylor Tool Life Calculator

Posted : adminOn 6/7/2018Shares 4 I have another new tool for fellow squawkers! This time I’ve created a Loan Amortization Calculator for your calculating pleasure. This tool will help you better manage debt and plan payments for debt reduction. My hope is you will save big interest bucks tomorrow by better managing and paying down debt today. Use this tool for mortgages, loans, and any other debt which requires a plan of action!

Use the Loan Amortization Calculator to: • Enter a loan amount and term duration. • Calculate monthly, weekly, or twice weekly payment schedules. • Calculate interest rates, total payments, and total interest paid. • Run reports to view the Loan Amortization Report and to see the big debt reduction picture. To use the Loan Amortization Calculator: • Open the.

• Loan Amount: Enter the total amount for the loan (for example: 325000). • Term: Enter the length of the loan term. From the drop-down list, select the term duration (for example: Months or Years). • Interest Rate: Enter the darn interest rate for the loan. Install Rcs On Windows. • Payment Period: From the drop-down list, select the preferred payment period (for example: Monthly, Twice Monthly, Every Two Weeks, or Weekly).

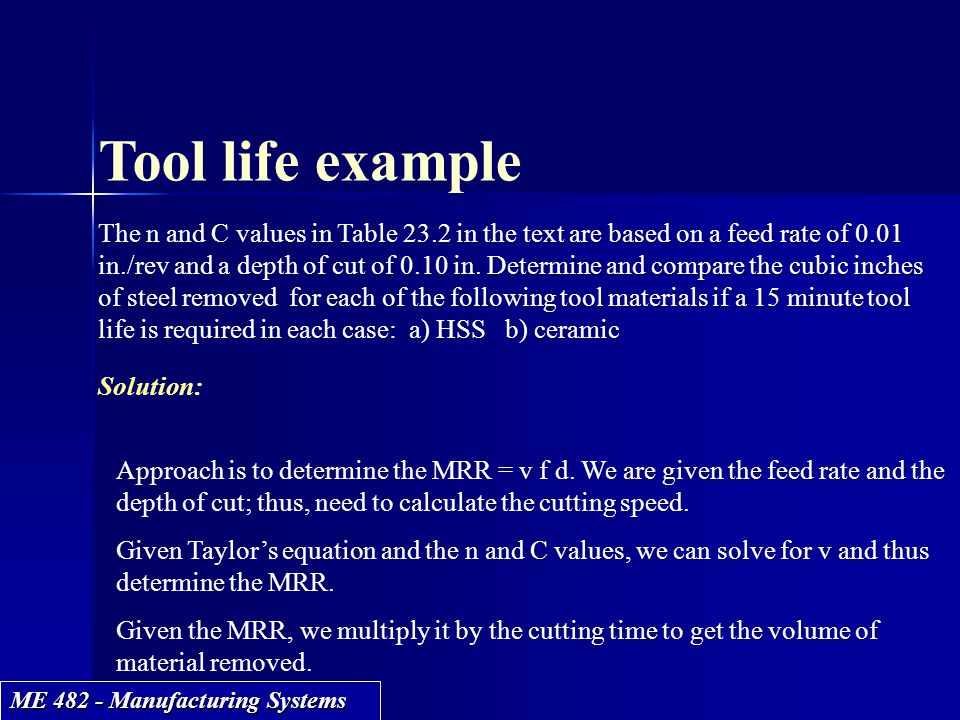

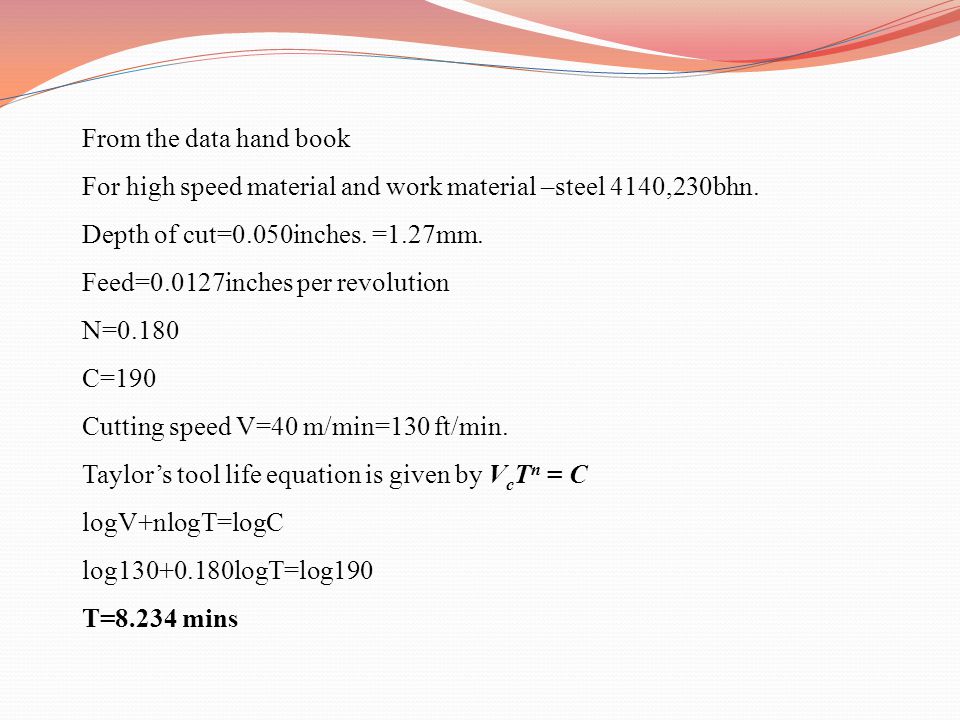

The applicable Taylor tool life equation has parameters: n 1⁄4 0.26 and C 1⁄4 900 (ft/min). As indicated in Section 23.4, the effect of a cutting fluid is to increase the value of C in the Taylor tool life equation. Justify you answer with calculations, using cost per cubic in of metal machined as the criterion of comparison. Online calculator. This is simple day calculator which determines number of days between two dates.

• Click Calculate. Results are calculated and display below. View payments, total paid, and total interest.

Download Rns 310 Maps Yahoo more. • Click View Report. Far Cry 2 Download Bittorrent more. A detailed Loan Amortization Report opens in either a new tab or window (depends on your web browser settings). Use this report to better manage debt and plan payments for debt reduction.

Let me know what you think!